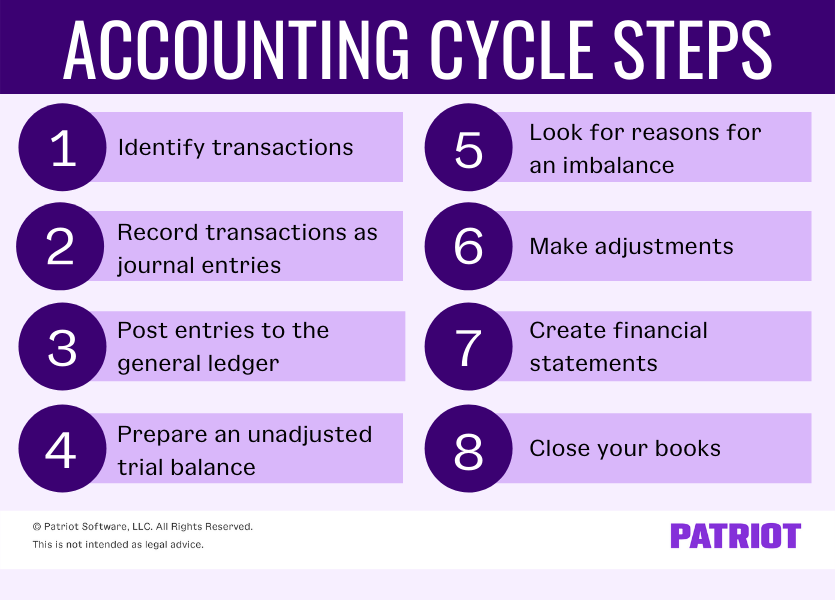

The Accounting Cycle: 8 Steps You Need To Know

The next step of the accounting cycle is to organize the various accounts by preparing two important financial statements, namely, the income statement and the balance sheet. The income statement lists all expenses incurred as well as all revenues collected by the entity during its financial period. These expenses and revenues are compared to reveal the net income earned or net loss sustained by the entity during the period. It includes beginning balances for each account, all transactions impacting those accounts during the accounting period, and each account’s ending balance. Without the ledger, business owners couldn’t generate reports, prepare financial statements, or analyze the results of their day-to-day operations.

Order to Cash

If a Bank transfer is done to pay for it, the bank balance is an asset, decreasing on the credit side. After the financials are prepared, the next period opens and the cycle starts over again. Janet-Berry Johnson is a freelance writer, who writes content for BILL.

Step 7. Create financial statements

It is important that these transactions are identified as they occur. While this used to be done manually, accounting software now makes this task easy. What was once difficult to stay on top of is now how to calculate taxable income easy for anyone to manage. There are several different amounts of time that a company may choose to report on. Some have a monthly accounting period, while others only report on an annual basis.

Small Business Resources

Calculating these balances is crucial, as they are used for testing and analysis. For example, when a transaction is recorded using accrual accounting, it happens at the time of the sale. This happens regardless of whether or not cash has moved in or out of business. It creates a debit for where the money is going, and a credit for where it is ending up. The identification of transactions is, arguably, the most important step in the process.

- There are lots of variations of the accounting cycle—especially between cash and accrual accounting types.

- An accounting period is the time period that financial statements refer to.

- This is the point in the cycle where the method of accounting has to be chosen.

- The cycle repeats itself every fiscal year as long as a company remains in business.

- Depending on the solution, bookkeepers, certified public accountants and business owners don’t have to intervene or perform some accounting cycle tasks manually.

Continue learning with BILL

The accounting cycle is an eight-step process that accountants and business owners use to manage the company’s books throughout a specific accounting period, such as the fiscal year. The general ledger serves as the eyes and ears of bookkeepers and accountants and shows all financial transactions within a business. Essentially, it is a huge compilation of all transactions recorded on a specific document or in accounting software.

Posting to the general ledger

These T-accounts are then used to prepare an unadjusted trial balance. This trial balance represents the actual account balances in the ledger. It does not however reflect the balances that should be in the accounts. Some period-end adjustments typically need to be made before the books can be closed. The accounting cycle is a holistic process that records a business’s transactions from start to finish, helping companies stay organized and efficient. The cycle incorporates all the organization’s accounts, including T-accounts, credits, debits, journal entries, financial statements and book closing.

After you’ve transferred your income and expenses into the Income Summary account, you’ll close that account, moving the balance to Retained Earnings, which is a permanent account. The accounting cycle ends with closing the books, typically occurring at the end of a month, quarter, or fiscal or calendar year. If a transaction is accepted, you can move on to recording it in the company’s books. If it was an error or looks suspicious, you should reach out to the customer or vendor to remove or replace it. In the end, the accounting cycle is a vital part of keeping a business financially healthy and ready to make good decisions for its future. We collaborate with business-to-business vendors, connecting them with potential buyers.

The process starts with analyzing incoming and outgoing transactions like purchases and sales. It ends with preparing financial statements, like the balance sheet, income statement, and cash flow statement, and closing the books. The trial balance gives you an idea of each account’s unadjusted balance. Such balances are then carried forward to the next step for testing and analysis.

The closing step impacts only temporary accounts, which include revenue, expense, and dividend accounts. The permanent or real accounts are not closed; rather, their balances are carried forward to the next financial period. Adjustments in the accounting cycle are made at the end of an accounting period to ensure that revenues and expenses are recorded in the period in which they are incurred. These adjustments, which include accrued revenues, accrued expenses, deferred revenues, and deferred expenses, are essential for adhering to the accrual basis of accounting. They ensure that the financial statements present an accurate and fair view of the company’s financial position and performance for the period.

Each business transaction must be properly analyzed so that it can be correctly recorded in the journal. BILL Spend & Expense simplifies capturing, supporting, and recording transactions by doing the heavy lifting for you, and it even syncs with most popular accounting software platforms. Ray’s accounting system creates journal entries for his bank and credit card transactions automatically. When a bookkeeper identifies adjustments that need to be made, they have to create new journal entries.

Leave a Reply

Want to join the discussion?Feel free to contribute!