What is an accounting cycle? California Learning Resource Network

Double-entry bookkeeping refers to recording every transaction in at least two accounts — a Debit on one side and a Credit on the other. This recording system provides a system of checks and balances in the company’s books and helps prevent fraud and errors. The accounting cycle is the process of recording financial transactions and reporting activity within a business. After identification, transactions are recorded in accounting journals.

Close the books for the accounting period.

To fully understand the accounting cycle, it’s important to have a solid understanding of the basic accounting principles. You need to know about revenue recognition (when a company can record sales revenue), the matching principle (matching expenses to revenues), and the accrual principle. Ray prints out his trial balance and quickly scans the ending balance for each account, looking for any irregularities or unexpected balances.

Step #8: Close the books

One of the major modifications you can make is the type of accounting method used. Organizations may follow cash accounting or accrual accounting or choose between single-entry and double-entry accounting. At the end of the accounting period, companies must prepare financial statements. Public entities need to comply with regulations and submit financial statements before specified deadlines. Understanding the accounting cycle is important for anyone in the world of business. Through accounting, financial responsibility can be taken by a company.

Use of accounting software

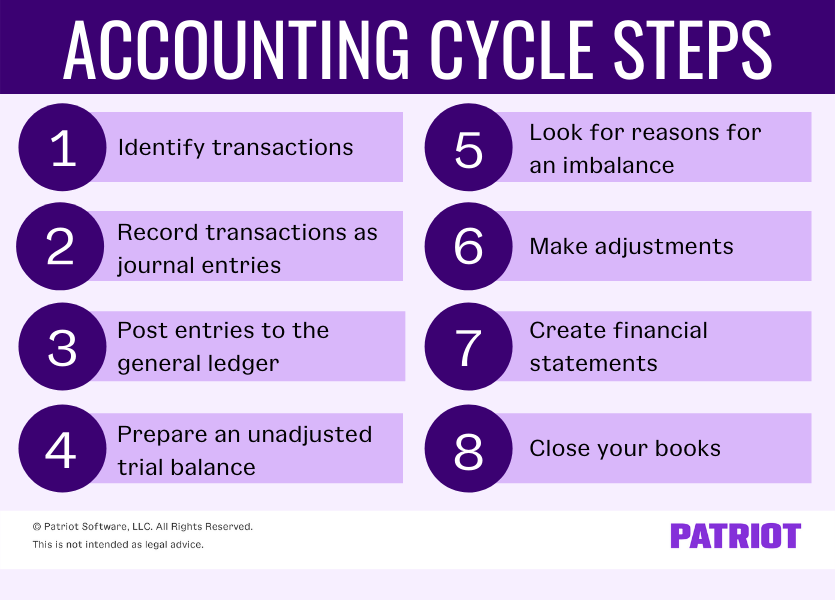

The accounting cycle is a critical process that ensures accurate and reliable financial reporting, compliance with regulatory requirements, and improved financial decision-making. While the cycle can be complex and challenging, it is essential for businesses and organizations to ensure their financial success. By understanding the components, steps, and benefits of the accounting cycle, companies can put themselves in a better position to succeed in today’s competitive business environment. Once you’ve posted all of your adjusting entries, it’s time to create another trial balance, this time taking into account all of the adjusting entries you’ve made. At the end of the accounting period, you’ll prepare an unadjusted trial balance. Finally, you need to post closing entries that transfer balances from your temporary accounts to your permanent accounts.

- It details the date, accounts affected, and amounts involved in each transaction.

- It will disclose the parties involved, amount and time of transfer of payment, etc.

- Through its structured process of recording and analyzing financial data, businesses can track their financial health, profitability, and cash flows.

From identifying transactions to preparing financial statements, the 8 steps in the accounting cycle ensure accurate record-keeping. A trial balance restaurant and food service supply chain solutions is prepared to test the equality of the debits and credits. All account balances are extracted from the ledger and arranged in one report.

Financial Statements

While the income statement shows revenue and expenses that don’t cost literal money (like depreciation), the cash flow statement covers all transactions where funds enter or leave your accounts. The trial balance is a critical component that lists all the account balances in the ledger. Its purpose is to verify that the total debits equal the total credits, ensuring that entries are mathematically correct. There are many essential parts of your business’s operations and keeping accurate financial records is fundamental among them. Let accounting software work behind the scenes to perform critical tasks.

It groups all transactions that affect a specific account, making it easier to see the overall impact on each account. The next step involves transferring the journal entries to the general ledger. Here, transactions are categorized into respective accounts, providing a clear view of each account’s activity over a period. One of the accounting cycle’s main objectives is to ensure all the finances during the accounting period are recorded and reflected in the statements accurately. Learn the eight steps in the accounting cycle process to complete your company’s bookkeeping tasks accurately and manage your finances better. There are two options; single-entry accounting and double-entry accounting.

Interpreting financial statements helps you stay on top of your company’s finances and devise growth strategies. Your accounting type and method determine when you identify expenses and income. For accrual accounting, you’ll identify financial transactions when they are incurred. Meanwhile, cash accounting involves looking for transactions whenever cash changes hands. At the end of any accounting period, a trial balance is calculated for all accounts on the general ledger. This trial balance tells the company the amount of cash each unadjusted account is worth.

If the amount is negative, it means that the company had incurred a loss and if the amount is positive, it means that the company had earned a significant profit within the specific time period. The accounting cycle is critical because it helps to ensure accurate bookkeeping. Skipping steps in this eight-step process will likely lead to an accumulation of errors. If these errors aren’t caught and corrected, they can give you and your employees an inaccurate view of your company’s financial situation. The fundamental concepts above will enable you to construct an income statement, balance sheet, and cash flow statement, which are the most important steps in the accounting cycle. It’s important because it can help ensure that the financial transactions that occur throughout an accounting period are accurately and properly recorded and reported.

Once you check off all the steps, you can move to the next accounting period. To gain a better understanding of this, consider an error in the general ledger. This entry needs to reference where the error exists so that anyone reviewing it can verify it for accuracy. If a transaction is identified but it isn’t recorded, then it’s like it never happened at all. An example of identifying transactions would start with point-of-sale software. Many of these software options automatically identify a transaction.

When she’s not writing, Barbara likes to research public companies and play Pickleball, Texas Hold ‘em poker, bridge, and Mah Jongg. If you have a staff, give them the tools they need to succeed in implementing the accounting cycle. This could mean providing quarterly training on best practices, meeting with your staff each cycle to find their pain points, or equipping them with the proper accounting tools. If you use accounting software, this usually means you’ve made a mistake inputting information into the system. The general ledger is like the master key of your bookkeeping setup. If you’re looking for any financial record for your business, the fastest way is to check the ledger.

Leave a Reply

Want to join the discussion?Feel free to contribute!